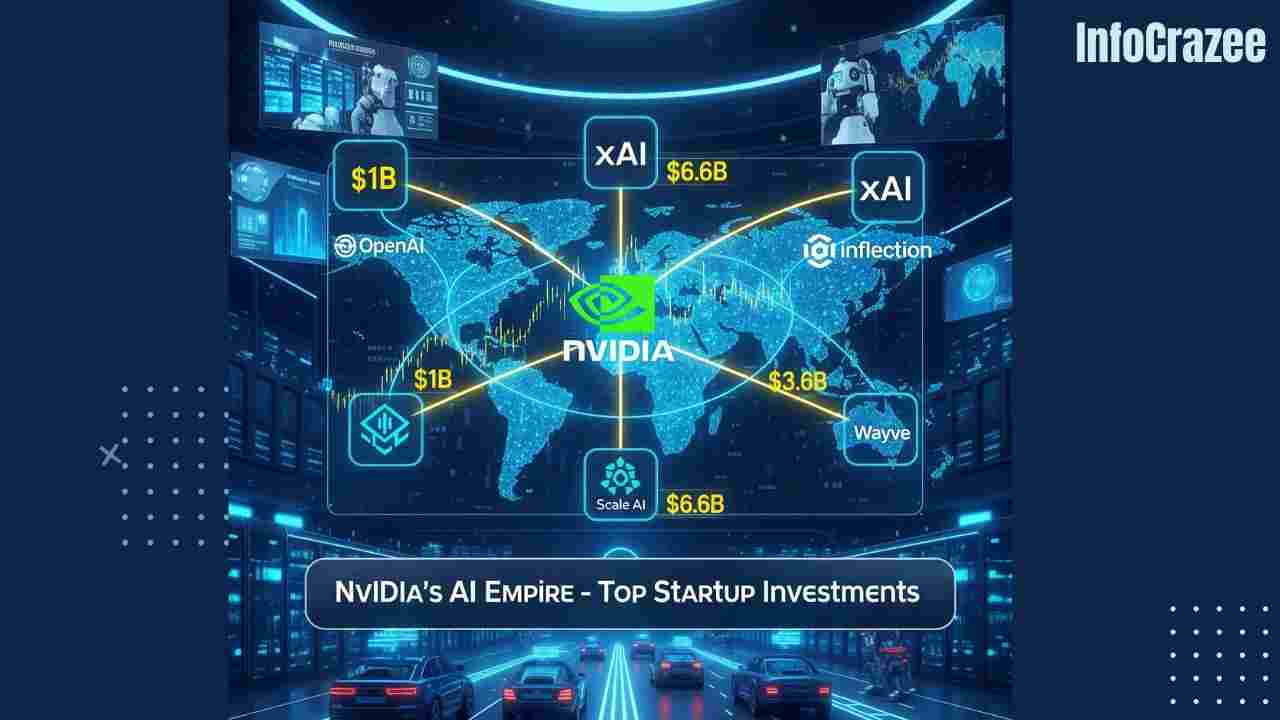

Inside Nvidia’s AI Empire: Top Startup Investments Unveiled

Nvidia, the world’s leading GPU manufacturer, has solidified its dominance in the AI revolution by investing heavily in over 80 AI startups over the past two years, leveraging its soaring revenue and $3 trillion market cap. A recent TechCrunch report details Nvidia’s strategic venture capital activity, revealing its top investments in transformative AI companies, from generative AI to robotics and cloud infrastructure.

Nvidia’s investment spree, which ramped up to 49 funding rounds in 2024 from 34 in 2023, outpaces competitors like Alphabet and Microsoft, with 83 deals since 2023, according to PitchBook data. CEO Jensen Huang’s hands-on approach, personally approving each investment, underscores Nvidia’s goal to expand the AI ecosystem while securing demand for its chips.

Nvidia’s Top AI Startup Investments

- OpenAI: In October 2024, Nvidia invested $100 million in OpenAI’s $6.6 billion round, valuing the ChatGPT maker at $157 billion. Despite OpenAI’s request to avoid funding competitors, Nvidia also backed rival xAI, showing its strategic flexibility.

- xAI: Nvidia joined xAI’s $6 billion round in 2024, supporting Elon Musk’s generative AI venture, which operates a supercomputer powered by 100,000 Nvidia H100 GPUs. The investment aligns with xAI’s plan to acquire another 100,000 GPUs.

- Scale AI: In May 2024, Nvidia contributed to Scale AI’s $1 billion round, valuing the data-labeling startup at $14 billion. Scale’s services are critical for training AI models, serving clients like OpenAI and Meta.

- CoreWeave: Nvidia’s stake in CoreWeave, an AI cloud provider, has soared, with a 7% holding now worth $3.7 billion after the startup’s IPO in March 2025. CoreWeave’s data centers, packed with Nvidia GPUs, highlight the chipmaker’s focus on infrastructure.

- Figure AI: Nvidia invested in Figure AI’s $675 million Series B in February 2024, valuing the AI robotics startup at $2.6 billion. Figure’s humanoid robots aim to transform industries like manufacturing.

- Mistral AI: Nvidia backed Mistral AI’s $640 million Series B in June 2024, valuing the French LLM developer at $6 billion, reinforcing its commitment to global AI innovation.

- Perplexity: Nvidia has invested in every Perplexity round since November 2023, including a $500 million round in December 2024, valuing the AI search engine at $9 billion. Huang has publicly praised Perplexity’s potential to rival Google.

- Cohere: Nvidia participated in Cohere’s $500 million round in June 2024, building on its 2023 investment in the Toronto-based LLM provider for enterprises.

- Inflection: In June 2023, Nvidia led Inflection’s $1.3 billion round, but the startup faced challenges after Microsoft hired its founders in 2024, leaving its future uncertain.

- Sakana AI: In September 2024, Nvidia invested in Tokyo-based Sakana AI’s $100 million round, supporting accessible AI models trained on small datasets, with plans for AI data centers in Japan.

Strategic Vision and Market Impact

Nvidia’s investments, which exclude its Ventures fund’s 24 deals in 2024, focus on “game changers and market makers” to drive AI adoption and ensure a steady customer base for its GPUs. The company’s $1 billion in AI deals last year alone outstripped Amazon and Microsoft, though Google led with 120 VC rounds.

Reflect enthusiasm for Nvidia’s strategy, “Nvidia’s AI empire: A look at its top startup investments,” and @chiefaioffice highlighting its $700 million acquisition of Run:ai in 2024. However, regulators are scrutinizing Nvidia’s dominance, with the U.S. Department of Justice launching antitrust probes into its market practices and acquisitions, raising concerns about exclusivity through startup stakes.

Looking Ahead

Nvidia’s investment portfolio, now valued at over $1.5 billion, positions it as a central player in the $330 billion AI startup boom since 2023. By backing diverse sectors—LLMs, cloud computing, robotics, and autonomous vehicles—Nvidia is shaping the future of AI while reinforcing its hardware dominance. As Huang told Wired, these investments help Nvidia “see into the future,” ensuring it stays ahead in a rapidly evolving landscape.