How the 2025 Budget Bill Impacts Hospital Revenue, Funding, and Emergency Readiness

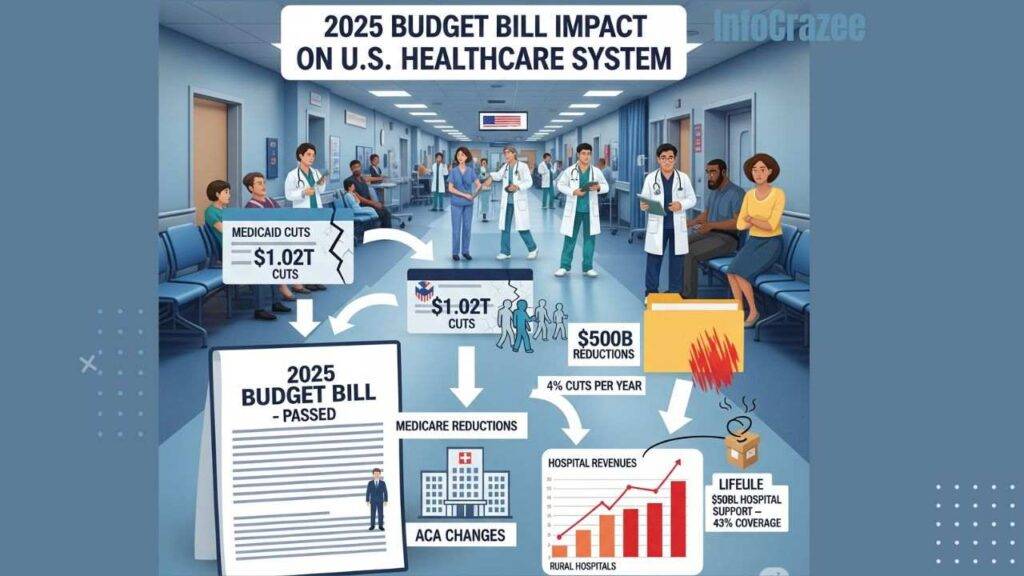

The “One Big Beautiful Bill Act” (H.R. 1), signed into law on July 4, 2025, introduces sweeping changes to U.S. healthcare through significant cuts to Medicaid, Medicare, and Affordable Care Act (ACA) programs. With nearly $1.2 trillion in reductions to federal healthcare spending, the bill reshapes hospital revenue streams, funding structures, and emergency preparedness. This blog examines the key provisions of the 2025 budget bill, their implications for hospitals, and strategies for navigating the new financial and operational landscape, with a focus on maintaining fiscal stability and emergency readiness.

Key Provisions of the 2025 Budget Bill

The budget reconciliation bill, passed by the U.S. House on May 22, 2025, and the Senate shortly after, prioritizes tax cuts and fiscal restraint, offsetting costs with deep reductions in healthcare programs. Key provisions impacting hospitals include:

- Medicaid Cuts: The bill slashes Medicaid funding by $1.02 trillion over 10 years, reducing enrollment by an estimated 10.5 million people by 2034. It introduces work requirements (80 hours per month for able-bodied adults up to age 65), limits state provider taxes from 6% to 3.5% of net patient revenue, and bans payments for healthcare provided to most lawfully present migrants.

- Medicare Reductions: A 2.5% increase to the Medicare Physician Fee Schedule in 2026 provides short-term relief, but long-term cuts of 4% per year are projected to reduce Medicare funding by over $500 billion from 2026 to 2034. Additionally, $16 billion in cuts to Medicare disproportionate share hospital (DSH) payments will occur over three years.

- ACA Changes: The bill increases the uninsured population by 10.9 million (7.8 million from Medicaid, 3.1 million from ACA exchanges) due to stricter eligibility, reduced subsidies, and a shortened enrollment period.

- Rural Hospital Support: A $50 billion fund over five years aims to mitigate losses for rural hospitals, but experts argue it falls short, covering only 43% of needed relief.

These changes, framed as efforts to curb federal spending, pose significant financial and operational challenges for hospitals, particularly those serving low-income and rural communities.

Impact on Hospital Revenue

1. Increased Uncompensated Care

The Congressional Budget Office (CBO) projects a 10.9 million increase in uninsured Americans, leading to a $31 billion annual rise in uncompensated care costs. Hospitals, especially in high-Medicaid regions, will face:

- Higher Self-Pay Volumes: Reduced Medicaid and ACA coverage will increase self-pay patients, straining revenue cycle management (RCM) as patients struggle to cover costs.

- Charity Care Demand: Hospitals will see greater demand for financial assistance, requiring robust screening and cost estimation tools to manage bad debt.

- Example: Urban safety-net hospitals, reliant on Medicaid for up to 30% of revenue, could see operating margins shrink further, with 44% of rural hospitals already operating at negative margins in 2023.

2. Reduced Medicaid Reimbursements

Medicaid cuts and restrictions on provider taxes will reduce hospital payments:

- Provider Tax Limits: States use provider taxes to boost federal matching funds, often paying hospitals more than Medicaid’s base rates. The reduction to 3.5% limits this revenue stream, with rural hospitals losing an estimated 21 cents per dollar of Medicaid funding.

- State Budget Strains: States may cut optional benefits (e.g., dental, vision) or lower provider rates to offset federal cuts, further reducing hospital revenue.

- Impact: Rural hospitals, where Medicaid covers nearly half of children and one in five adults, face heightened closure risks. The National Rural Health Association estimates $70 billion in total Medicaid reimbursement cuts for rural hospitals over 10 years.

3. Medicare Funding Pressures

The 4% annual Medicare cuts and $16 billion DSH reduction will hit hospitals serving low-income and elderly patients hardest:

- Disproportionate Impact: Rural and urban safety-net hospitals, already operating on thin margins (3.1% average for rural hospitals in 2023), face increased financial distress.

- Long-Term Outlook: Unless Congress intervenes, as it has historically, the $500 billion Medicare reduction will force hospitals to cut services or staff.

Impact on Emergency Readiness

1. Strain on Emergency Departments

The rise in uninsured patients will drive higher emergency department (ED) utilization:

- Increased Demand: Newly uninsured patients, particularly those with chronic conditions, are likely to seek care in EDs, overwhelming capacity.

- Rural Challenges: With over 300 rural hospitals at immediate closure risk, patients in remote areas may face 45-minute to one-hour travel times for emergency care, exacerbating health disparities.

- Example: Day Kimball Hospital in Connecticut, where 30% of patients rely on Medicaid, faces closure risks, leaving patients like Bruce Shay without local emergency access.

2. Reduced Capacity for Disaster Response

Financially strained hospitals may cut investments in emergency preparedness:

- Staffing Shortages: Budget constraints could lead to layoffs, reducing trained personnel for disaster response. A 2025 KFF report estimates 1.22 million job losses nationwide due to Medicaid and Medicare cuts.

- Service Reductions: Hospitals may eliminate critical services like obstetrics or behavioral health, limiting their ability to respond to community health crises.

- Infrastructure Gaps: Limited funds for upgrading facilities or stockpiling supplies could weaken readiness for pandemics or natural disasters.

3. Rural Hospital Closures

The $50 billion rural health fund is insufficient to offset $155 billion in Medicaid cuts to rural areas over 10 years. Kentucky alone faces a $12.3 billion loss, threatening widespread closures.

- Impact: Closures reduce access to emergency care, increase mortality rates for time-sensitive conditions, and destabilize local economies where hospitals are major employers.

Strategies for Hospitals to Adapt

To mitigate the bill’s impact, hospitals must adopt proactive strategies:

1. Optimize Revenue Cycle Management

- Technology Investments: Scalable RCM tools, like those from Experian Health, can manage increased self-pay volumes, streamline collections, and enhance financial assistance screening.

- Patient Education: Implement clear cost-sharing communication to help patients understand new Medicaid requirements, reducing unpaid bills.

2. Strengthen Financial Resilience

- Diversify Revenue: Expand outpatient services, telehealth, or partnerships with private payers to offset Medicaid and Medicare losses.

- Cost Control: Use data analytics to identify inefficiencies and optimize staffing without compromising care quality.

3. Enhance Emergency Preparedness

- Regional Collaboration: Partner with nearby hospitals to share resources and maintain emergency capacity.

- Grant Funding: Pursue state or federal grants, like Georgia’s $2.1 billion Medicaid reimbursement initiative, to bolster emergency services.

4. Advocate for Policy Relief

- Engage Lawmakers: Hospitals should work with groups like the National Rural Health Association to push for exemptions or increased rural funding.

- Community Outreach: Educate patients on coverage changes to reduce ED overuse and support advocacy for sustainable funding.

The Bigger Picture

The 2025 budget bill’s healthcare cuts will have far-reaching consequences, particularly for rural and safety-net hospitals. The CBO estimates a $3 trillion increase in the national debt, suggesting limited economic benefits from the cuts, while healthcare access and quality could deteriorate. States like Georgia are already seeking creative solutions, but the scale of the cuts demands a coordinated response from healthcare leaders, policymakers, and communities.

Conclusion

The “One Big Beautiful Bill Act” challenges hospitals to navigate a new era of reduced funding and heightened demand. By leveraging technology, diversifying revenue, and prioritizing emergency preparedness, hospitals can mitigate financial risks and maintain critical services. For healthcare leaders, the path forward involves strategic adaptation, advocacy, and a commitment to patient-centered care in the face of unprecedented fiscal constraints. Staying proactive and resilient will be essential to weathering the storm and ensuring access to care for vulnerable populations in 2025 and beyond.

![Write page title Page titles should be around 580 pixels in length. Or meta description Meta descriptions should be around 920 pixels in length. On[ Healthcare Mergers and Acquisitions: Key Highlights from 2025 ] that is clear, simple, and engaging, using a friendly and conversational tone. Avoid generic or overly formal words like "delve," "comprehensive," or "leverage." Instead, use natural language that feels human and relatable. Structure the content with headings, subheadings, and bullet points to make it easy to scan and read.please give me Focus keyphrase.](https://infocrazee.com/wp-content/uploads/2025/08/wfucgw-dpcsjx-7-768x432.jpg)