Nvidia Zooms Back to World’s Most Valuable Company, Riding the AI Wave

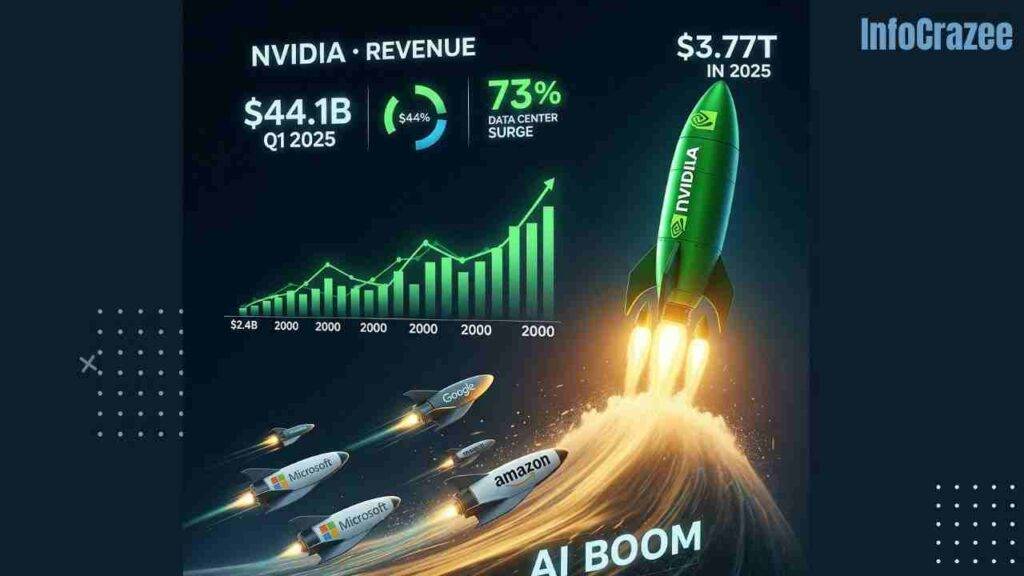

Guess who’s back on top? Nvidia has reclaimed its spot as the world’s most valuable company, hitting a jaw-dropping $3.77 trillion market cap on June 26, 2025, edging out Microsoft and Apple. Fueled by a red-hot demand for its AI chips, Nvidia’s stock soared over 4% to a record $154.31, and the buzz is only getting louder.

Why Nvidia’s Back on Top

Picture this: every major tech company—think Microsoft, Google, or Amazon—is racing to build smarter AI, and Nvidia’s chips are the rocket fuel powering it all. The company’s GPUs (graphics processing units) are the go-to for training massive AI models, and that demand sent Nvidia’s stock skyrocketing 63% since April, adding $1.5 trillion to its value. Here’s the lowdown:

- AI’s golden wave: Analysts are calling this a “Golden Wave” of AI adoption, with Nvidia’s chips at the heart of it.

- Monster earnings: Nvidia’s revenue jumped 69% to $44.1 billion in Q1 2025, with data center sales soaring 73%.

- Fun fact: From a $2.4 billion company in 2000 to $3.77 trillion today, Nvidia’s journey is like a tech fairy tale.

What’s Behind the AI Boom?

I remember when Nvidia was mostly known for gaming graphics cards—now it’s the king of AI. Their H100 and new Blackwell chips are the gold standard for data centers, where companies train AI models for everything from chatbots to self-driving cars. Here’s why Nvidia’s leading the pack:

Unmatched Chip Power

- Real-world win: Nvidia controls 82% of the GPU market and 98% of data center GPUs, making it the backbone of AI projects for Microsoft, Meta, and OpenAI.

- Example: When OpenAI trains models like ChatGPT, it’s Nvidia’s chips crunching the numbers behind the scenes.

Big Bets from Tech Giants

- Real-world win: Companies like Google and Amazon are pouring billions into AI infrastructure, snapping up Nvidia’s chips faster than they can be made.

- Example: A friend who works in cloud computing told me their company can’t get enough Nvidia GPUs to keep up with AI demand—it’s like a tech gold rush!

Robotics and Beyond

- Real-world win: Nvidia’s not just about chips; CEO Jensen Huang is pushing into robotics with projects like Tesla’s Optimus, which could be a “multitrillion-dollar” market.

- Example: Imagine factories using Nvidia-powered robots to handle repetitive tasks, freeing up workers for bigger ideas.

Why This Matters to You

You might be thinking, “Cool, Nvidia’s killing it, but what’s in it for me?” Whether you’re an investor, a small business owner, or just love tech, Nvidia’s rise affects you. At infocrazee, here’s how we see it:

- Investors: Nvidia’s stock is a hot ticket, with 90% of analysts saying “buy” and predictions it could hit $6 trillion in a few years. But it’s not cheap—think carefully before jumping in

- Businesses: If you’re using AI tools (like chatbots or data analytics), Nvidia’s tech is likely powering them, making your work faster and smarter.

- Tech fans: The AI boom means cooler gadgets and services, from smarter assistants to self-driving cars, are coming your way.

Challenges on the Horizon

Nvidia’s riding high, but it’s not all smooth sailing. Here are some hurdles to watch:

- China export restrictions: U.S. rules are blocking Nvidia’s H20 chip sales to China, costing $8 billion and a $4.5 billion inventory write-off.

- Competition: Google, Amazon, and Intel are building their own AI chips, which could chip away at Nvidia’s lead.

- High valuation: At a price-to-earnings ratio over 100, some worry Nvidia’s stock is priced for perfection.

How to Stay in the Game

Want to ride the AI wave or just keep up? Here’s how, straight from the infocrazee crew:

- For investors: Consider Nvidia stock during pullbacks, as suggested by analysts, to avoid overpaying. Check platforms like Bloomberg for price targets.

- For businesses: Explore Nvidia’s AI tools, like the Drive platform for autonomous vehicles, to boost your operations.

Pro tip: If you’re new to investing, start small and diversify—Nvidia’s a giant, but don’t put all your eggs in one basket!

A Personal Take

I’ll never forget my first gaming PC, powered by an Nvidia graphics card—it made my games look epic. Now, seeing Nvidia lead the AI revolution feels like watching an underdog become a superstar. But I wonder: with such a high valuation, can they keep the crown? For now, I’m rooting for them to keep pushing tech forward, from smarter AIs to robots that might one day tidy my desk!

What’s Next for Nvidia?

Nvidia’s not slowing down. CEO Jensen Huang says AI infrastructure is just getting started, and new chips like Blackwell are set to launch later in 2025. Analysts see Nvidia hitting $5 trillion or even $6 trillion in the next few years, driven by AI and robotics. Whether it’s powering self-driving cars or factory robots, Nvidia’s shaping a future that’s equal parts exciting and mind-blowing.